Russian Ruble: a Perfect Storm?

Published by Alba Di Rosa. .

Russian rouble Exchange rate Central banks Uncertainty Exchange rate risk Covid-19 Exchange ratesIn this week's currency column we take a look at the exchange rate dynamics of three strategic BRICS countries, such as Russia, Brazil and South Africa. In the foreign exchange market, the dynamics of their currencies can be considered as an indirect measure of the uncertainty affecting emerging economies, due to their status of floating currencies belonging to economies that are strongly open to foreign trade.

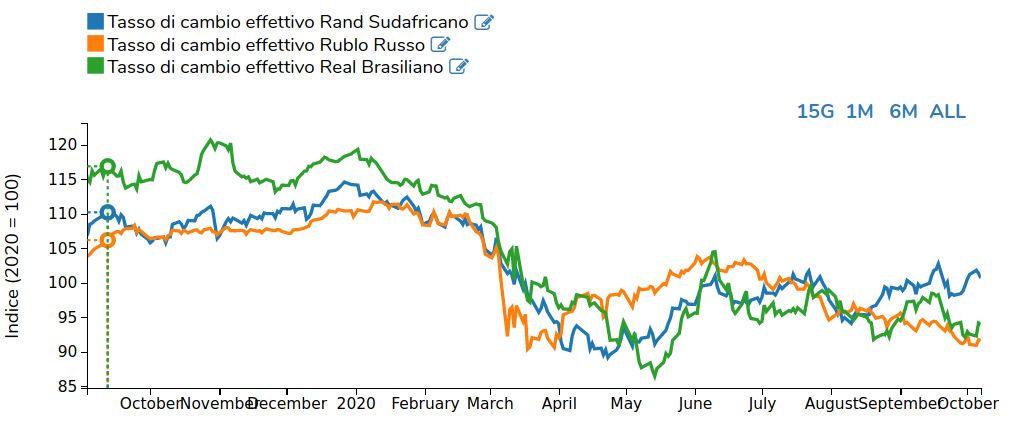

Thanks to the data available on DailyDataLab, it is possible to compare the effective exchange rate of the three currencies (index 2020 = 100). Focusing on the last 12 months, the dynamics of the series appear very similar: a relative stability in the last months of 2019, a collapse with the start of the Covid crisis and a subsequent rebound phase, partially reversed since June.

Effective exchange rate: South African Rand, Russian Ruble, Brazilian Real

In particular, since June the reversal of the trend is very clear for the Russian ruble; although with some upward fluctuation, the Brazilian real weakens, as well. On the contrary, the exchange rate of the South African rand remains on stronger levels, as can be seen from the graph.

Russia: multiple factors weigh on the ruble

We focus today on the analysis of the case of the ruble which, compared to the real, shows a sharper weakening dynamics. At the moment, the exchange rate of the Russian currency against the dollar has reached its early April levels; considering its exchange rate against the euro, the ruble has currently approached levels not seen since January 2016 (90.94 RUB/EUR). Since the beginning of the summer, the ruble has lost 10.7% of its value against the dollar and 17.4% against the euro.

The recent weakening of the ruble originates, according to analysts, from a variety of elements.

Geopolitical factors, related to tensions in Belarus and the poisoning of the Russian opposition leader Alexei Navalny (August 2020), with the consequent risk of new sanctions against Russia from the West.

As we wrote in this article, in the aftermath of the Belarusian presidential elections in early August, street protests broke out in the country (and are still ongoing), as the re-election of the outgoing president Lukashenko was considered rigged by protesters and numerous international observers. The European Union, for example, did not recognise the outcome of the elections.

However, Russian President Vladimir Putin remains President Lukashenko's historical ally; Russia has therefore indirectly entered the orbit of increased political risk, in the eyes of the financial markets.

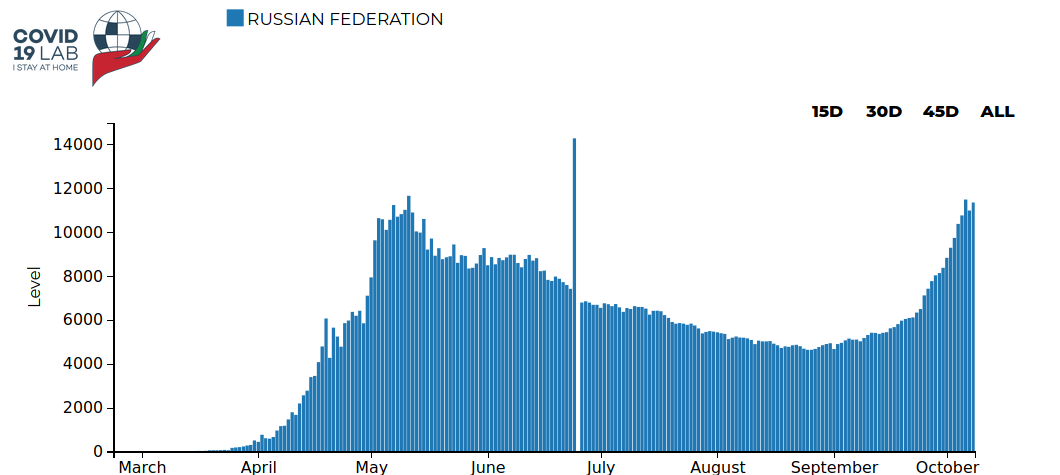

Health factors. As is happening in many other countries, between the end of September and early October infections resumed a strong upward trend in Russia and currently fluctuating above 10,000 new cases per day. The health risk therefore remains strongly on the scene for the country, also impacting on the dynamics of the currency.

Covid-19 daily confirmed cases: Russia

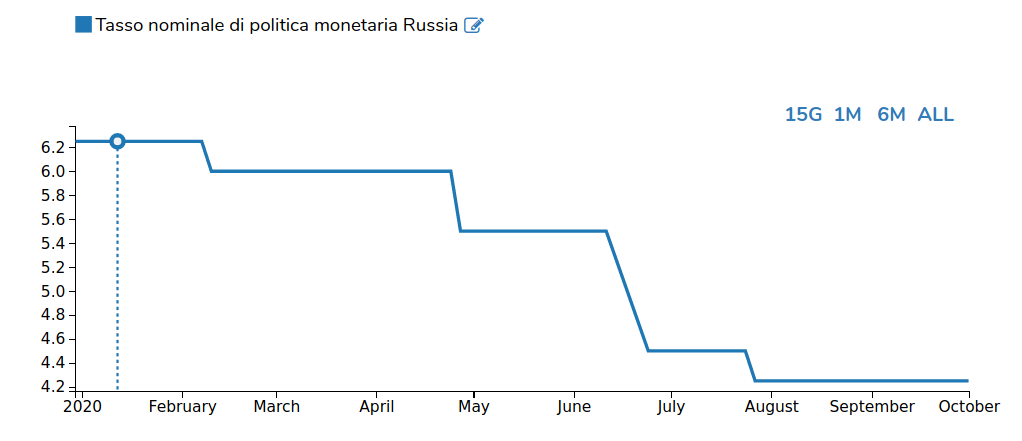

Monetary policy. The expansionary monetary policy of the Central Bank of Russia, which in recent months made several cuts in its reference interest rate, has certainly not helped the ruble: specifically, the key rate decreased from 5.5% at the beginning of June to 4.25% to date, an all-time low.

Nominal monetary policy rate: Russia

An additional monetary policy element to be borne in mind is the reduction of central bank interventions in terms of sales of FX reserves in the summer months, compared to the previous period: lowering this "protection" for the currency makes it more volatile, in the face of investors' appetite.

In this context of currency weakening, however, the central bank seems to have decided to change course and increase its FX sales in October.

Balance of payments. Another element that helps to explain the dynamics of the ruble is the weakness of several elements of the Russian balance of payments: the current account balance and the capital account presented deficits of 0.5 and 0.2 billion dollars respectively in the second quarter of 2020. For the dynamics of the trade balance, of significant importance is the reduction in foreign currency revenues from oil and natural gas exports, given the reduction in global demand and prices linked to the pandemic.

External factors. As an EM currency, the dynamics of the ruble also reflects the level of markets' appetite for risk, which at the moment does not seem high, in relation to the persistence of the health emergency but also the uncertainty regarding the upcoming US presidential elections.